Cross Asset Volatility Crush

Traders, this was a truly remarkable two weeks of price action in a year filled with remarkable price action already. After two months of understandable jitters, balance, and tactical trading, the clean sweep election did the one thing the market loves above all else - the removal of uncertainty. As @Markets and Mayhem put it, the outcome was a cross asset volatility crush of the highest order. Especially with much of the earnings and economic data behind, the market was once again given the all clear to continue higher in spectacular fashion as volatility subsided completely. Ultimately, this was a binary event that was only tradeable through futures, but even I was surprised at the total irrelevance of the structure of the past two months of action. All was well.

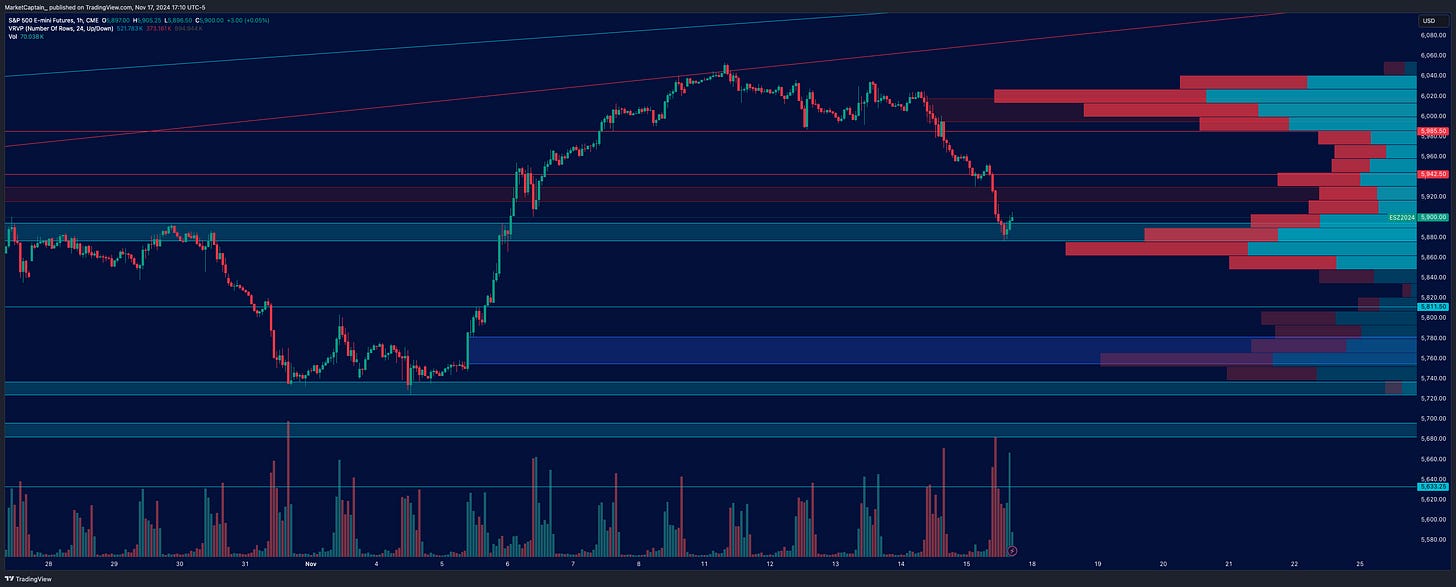

However, no matter how good the news, certain facts remained at the beginning of this week - the massive election gap up was on relatively light volume versus regular trading and there was very little structure created. This only really matters is the area is revisited, and accordingly bulls bid heavily on every dip until Thursday afternoon, when Powell indicated that the Fed was in no hurry for more rate cuts. This proved to be enough to force some revisiting of our poor structure, and thus we saw a liquidation to end the week. While sentiment was quite bullish, enough longs were trapped above to force a substantial sell with no structure to catch it. Now, however, we are in a state of repair where the market can now resume upwards if it chooses to.

There were many ways to make money the last two weeks even post election - knowing how many shorts were below, buying the dips and equal lows made a lot of sense. But also, knowing the nature of our modern markets allowed for some great short opportunities when they arose. All in all, treating it as another week and reacting to the dynamics at play will always be the right approach. Now, we have a good scenario this week for the return of a little volatility and nice movement.

Market Horizon

This week, it is highly instructive to zoom in a little bit on the hourly to illustrate everything described above. We see the rip, the consolidation, and eventually the failed resolution upward that trapped the longs in that volume node, forcing us back through the poor structure left by the election move. Where did we bounce on Friday? The previous resistance turned support and the consolidation area from election night - i.e. the next structure. Targeting these areas and not being afraid to push shorts if we have a bearish tape is what allows us to profit in both directions.

We are now right back at that pivot and the main battle that will define the week in my opinion is the previous all time high area of 5915 to 5930. This is now a heavy supply from Friday and must be reclaimed by bulls for upside. Above that, we may retest the 5985 area that was the weekly low and another big sell zone from Thursday which heralded this downside. Above 6025, the longs still holding are back in profit and we can trend further.

Below, I expect good support tonight and early in the week down to 5867, the volume node. If breached, we again have zero structure and volume to hold us up and might fully fill the gap to 5811, pre election closing price. There is then a great demand zone from 5755 to 5780 where institutions are now comfortably long. That would be an excellent area to rebid.

Other Indexes

NQ: Not the week you want to have. Could not hold all time highs, trendline rejection, and also accepted back into the difficult range from 19800 to 20800 that governed much of the last few months. Bull want the latter to quickly reclaim, or to see bounces around the election day demand zones.

YM: Dow looks a little stronger and is still technically in retest area. I don’t need to tell you again how poor the structure is on that ridiculous election candle though. If Friday’s low is taken out, watch out.

RTY: Similar vibe to YM but continues to be the strongest structurally. If 2300-2320 can hold, I expect happier times ahead. Otherwise we can retest the higher lows pattern.

Related Markets

Big reactions as one might expect in the macro sensitive areas and screaming risk on. Bonds remain very unhappy and yields continue to trend up, this typically heralds evil before long. Major dump of precious metals, could be a sign of risk on in this context. Bitcoin got the weekly breakout many hoped for and signals ample liquidity and animal spirits. Oil testing major lows along with volatility. Consumer staples and healthcare stocks all dumping. This market is all in on risk right now.

Economically, GDP strong and labor market still good with a few cracks. Rates slowly coming down but coming down nonetheless.

The broader stock market is more likely to suffer (and thrive inverse) when:

-Bonds/TLT/ZB are weakening, TNX/Bond Yield trending up (currently weakening, up)

-Gold/metals are weakening (currently weakening)

-Bitcoin is weakening (currently strengthening)

-Oil is strengthening (currently weakening)

-Inflation is trending upward (currently neutral)

-GDP growth is trending downward (currently upward)

-The labor market and wage growth is weakening (currently neutral)

-VIX is trending upward (currently downward)

-DXY (Dollar) is strengthening (currently strengthening)

-FED Interest rates are trending upward (currently downward)

-FED balance sheet is trending downward (currently neutral)

-Healthcare/Cons. Staple stocks are strengthening while other sectors weaken (currently weakening)

6 out of 11 factors positive, 3 negative, 4 neutral - Mostly bullish but a few mixed signals from bonds etc., risk clearly on but will price follow?

We are probably returning to a tactical period where we await a new trend and fixing up some of the nonsense that occurred in recent weeks. Continue to stay frosty, but once we successfully retest some of these areas, we remain quite bullish. Stay long and stay hard in the grand scheme until we have real regime change.

And always remember…